Zurich Guard Refundable Accident Insurance Plan

Zurich Guard Refundable Accident Insurance Plan1,2 (“Zurich Guard”) is designed to provide an additional layer of safety to your life. Regardless of any claims made under the Policy, you will receive 100% of the Total Premiums Paid at maturity. Additionally, if no claims are made during the Policy Term, you will receive an additional No Claim Bonus Benefit of 5% of the Total Premiums Paid at maturity.

Key Features

| Sum Insured2 (HKD) | 150,000 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Benefits | In HKD | |||||||||||||

|

Accidental Death and Dismemberment Benefit5 |

150,000 | |||||||||||||

| less any outstanding premium | ||||||||||||||

| Double Benefit6 | Benefit payable under Accidental Death and Dismemberment Benefit will be doubled if the Accident is caused by designated conditions. | |||||||||||||

|

Accidental Medical Expenses Reimbursement Benefit7 (Maximum aggerate limit of A, B and C per Accident) |

2,000 | |||||||||||||

| A) Medical Expenses Reimbursement (per Accident) | Up to 2,000 | |||||||||||||

| B) Bone-setting and Acupuncture (per visit) | Up to 150 | |||||||||||||

| Maximum of 1 visit per day and 8 visits per Policy Year | ||||||||||||||

| C) Chiropractic treatment and physiotherapy (per visit) | Up to 250 | |||||||||||||

| Maximum of 1 visit per day and 8 visits per Policy Year | ||||||||||||||

| Accidental Hospital Income Benefit8 (per day) | 250 | |||||||||||||

| Maximum of 90 days of Confinement per Accident | ||||||||||||||

| Accidental Cash Benefit for Travelling between Hong Kong & GBA with Designated Transportation4 (per Accident) | 2,000 | |||||||||||||

| Premium Refund Benefit3 | Whether or not any claims have been made, if the Policy is terminated, we will pay you Premium Refund Benefit which equals to applicable percentage of the Total Premiums Paid as stated in schedule below.

|

|||||||||||||

| No Claims Bonus Benefit3 | 5% of Total Premiums Paid upon Policy maturity if no claim has been made | |||||||||||||

| Non-Accidental Death Benefit9 | The higher of 5,000 less any outstanding premium or 100% of Total Premiums Paid | |||||||||||||

| Plan options2 | 1 | 2 | 3 | 4 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sum Insured2 (HKD) | 150,000 | 300,000 | 600,000 | 1,000,000 | ||||||||||

| Benefits | In HKD | |||||||||||||

|

Accidental Death and Dismemberment Benefit5 |

150,000 | 300,000 | 600,000 | 1,000,000 | ||||||||||

| less any outstanding premium | ||||||||||||||

| Double Benefit6 | Benefit payable under Accidental Death and Dismemberment Benefit will be doubled if the Accident is caused by designated conditions. | |||||||||||||

|

Accidental Medical Expenses Reimbursement Benefit7(Maximum aggerate limit of A, B and C per Accident) |

2,000 | 3,000 | 4,500 | 6,000 | ||||||||||

| A) Medical Expenses Reimbursement (per Accident) | Up to 2,000 | Up to 3,000 | Up to 4,500 | Up to 6,000 | ||||||||||

| B) Bone-setting and Acupuncture (per visit) | Up to 150 | Up to 200 | Up to 250 | Up to 300 | ||||||||||

| Maximum of 1 visit per day and 8 visits per Policy Year | ||||||||||||||

| C) Chiropractic treatment and physiotherapy (per visit) | Up to 250 | Up to 300 | Up to 350 | Up to 400 | ||||||||||

| Maximum of 1 visit per day and 8 visits per Policy Year | ||||||||||||||

| Accidental Hospital Income Benefit8 (per day) | 250 | 450 | 600 | 800 | ||||||||||

| Maximum of 90 days of Confinement per Accident | ||||||||||||||

| Accidental Cash Benefit for Travelling between Hong Kong & GBA with Designated Transportation4 (per Accident) | 2,000 | 2,500 | 3,000 | 3,500 | ||||||||||

| Premium Refund Benefit3 | Whether or not any claims have been made, if the Policy is terminated, we will pay you Premium Refund Benefit which equals to applicable percentage of the Total Premiums Paid as stated in schedule below.

|

|||||||||||||

| No Claims Bonus Benefit3 | 5% of Total Premiums Paid upon Policy maturity if no claim has been made | |||||||||||||

| Non-Accidental Death Benefit9 | The higher of 5,000 less any outstanding premium or 100% of Total Premiums Paid | |||||||||||||

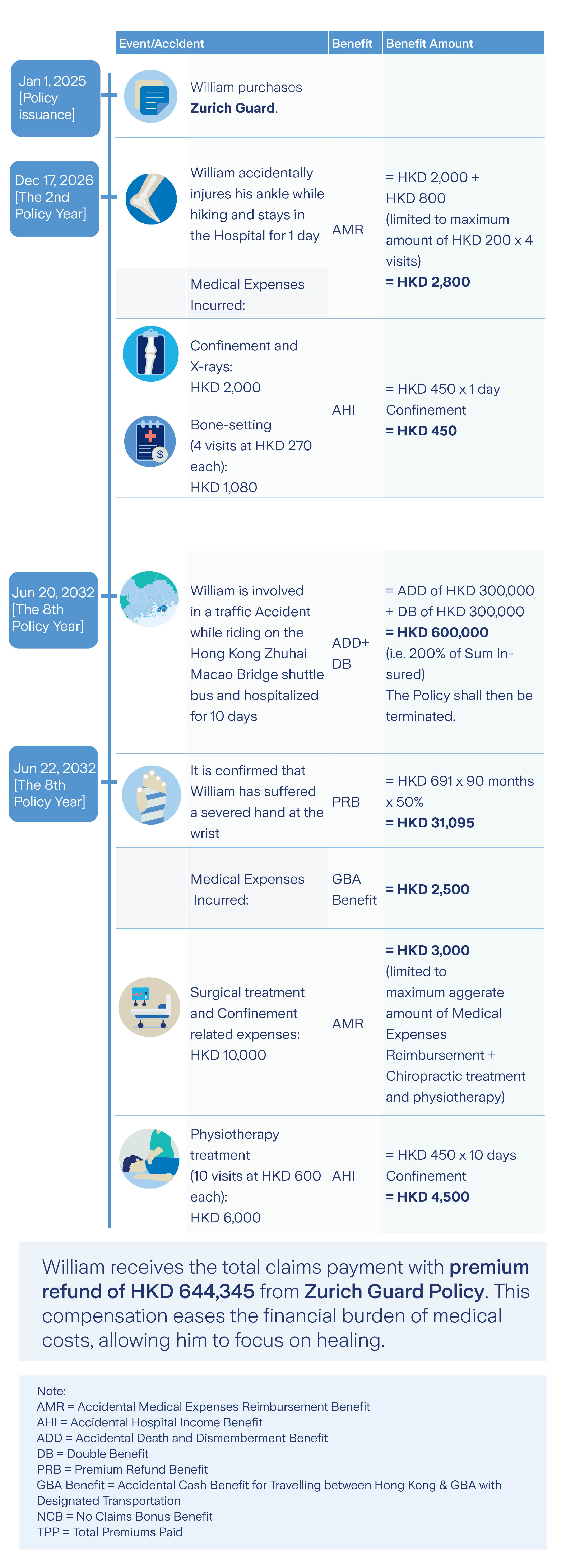

Case Study

![]()

William

Male / 30 (Age next birthday) / Married

• Policyholder & Life Insured: William

• Plan option: 2

• Sum Insured: HKD 300,000

• Premium Payment Term and premium payment frequency: 10 years, monthly

• Monthly premium: HKD 691

• Beneficiary and Contingent Policyholder: His wife, Jessica

William is married and enjoys outdoor activities and traveling. He understands that accidents can occur at any time while traveling or working, and he wants to ease the potential financial burden of significant medical expenses on his wife, Jessica. To address this concern, he purchases Zurich Guard and designates Jessica as the Beneficiary and Contingent Policyholder.

William is married and enjoys outdoor activities and traveling. He understands that accidents can occur at any time while traveling or working, and he wants to ease the potential financial burden of significant medical expenses on his wife, Jessica. To address this concern, he purchases Zurich Guard and designates Jessica as the Beneficiary and Contingent Policyholder.

The above examples are hypothetical and are for illustration purposes only. Zurich Guard purports to achieve the Life Insured’s objective to get insurance protection in view of the potentially high expenses on medical treatment for Bodily Injury. Zurich Guard provides personal accident coverage. For the details of the terms and conditions, please refer to the Policy documents and Policy Provisions.

Product summary table

| Issue Age (Age next birthday) | Age 1-66 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Premium Payment Term | 10 years | ||||||||

| Policy Term | 15 years | ||||||||

| Premium payment frequency | Monthly/Annually | ||||||||

| Premium structure* | Premium is level within the same designated Age groups below but non-guaranteed. | ||||||||

| Policy Currency | HKD | ||||||||

| Residency | Policyholder and Life Insured must be Hong Kong resident with a valid Hong Kong identity card and resides in Hong Kong. | ||||||||

| Plan options2 | 1 | 2 | 3 | 4 | |||||

| Sum Insured2 (HKD) | 150,000 | 300,000 | 600,000 | 1,000,000 | |||||

* We reserve the right to revise or adjust the premium upon each Policy Anniversary. The premium during the Premium Payment Term will not be increased based on individual circumstances or the Age of the Insured on next birthday. For details, please refer to “Key risks - Changes of benefits and/or regular premiums”.

Frequency Asked Questions (FAQs)

Know more

-

For the definitions of the words and expressions which are capitalized in this product factsheet, please refer to the Policy Provisions for details.

-

Change of plan option is not allowed after Policy issuance. There is a limit to the maximum aggregate Sum Insured per Life Insured under all policies of the Zurich Guard issued by us. For Life Insured who is under Age 19 (age next birthday) or a student at the time of application, only plan option 1 or 2 can be selected and each Life Insured is limited to have 1 policy in force only. You can contact our customer care team for enquiry(ies) for details.

-

Premium Refund Benefit and No Claims Bonus Benefit

105% of Total Premiums Paid at maturity is the sum of 100% of Total Premiums Paid under Premium Refund Benefit and 5% of Total Premiums Paid under No Claims Bonus Benefit.

- Accidental Cash Benefit for Travelling between Hong Kong & Greater Bay Area ("GBA") with Designated Transportation

Provided that the Life Insured has been entitled to any of the Accidental Death and Dismemberment Benefit, Double Benefit, Accidental Medical Expenses Reimbursement Benefit and/or Accidental Hospital Income Benefit, the Company shall pay an Accidental Cash Benefit for Travelling between Hong Kong & GBA with Designated Transportation if the Accidental Death or Bodily Injury of the Life Insured is caused by one of the following circumstances:

- while the Life Insured is driving or riding a Northbound Travel for Hong Kong Vehicle travelling between Hong Kong & GBA;

- while the Life Insured is riding as a fare-paying passenger on a Hong Kong Zhuhai Macao Bridge shuttle bus;

- while the Life Insured is riding as a fare-paying passenger on a High Speed Rail; or

- while the Life Insured is riding as a fare-paying passenger on a maritime public conveyance that is legally operated.

For the avoidance of doubt, the Accidental Cash Benefit for Travelling between Hong Kong & GBA with Designated Transportation will only be paid once even if 2 or more of the above conditions are met in the same Accident.

GBA means Macau, Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing (excluding Hong Kong).

- Accidental Death and Dismemberment Benefit

Any outstanding premium will be deducted from Accidental Death and Dismemberment Benefit when payable under the Policy.

Total and Permanent Disability is applicable from Age 19 (age next birthday) to the Policy Anniversary following the 75th birthday of the Life Insured on the date of the Accident.

Activities of Daily Living includes:

- getting in and out of a chair or a bed;

- moving from room to room;

- controlling bladder and bowel movements;

- getting dressed or undressed;

- taking a bath or a shower, including getting into and out of a tub;

- eating and swallowing food.

For details of other covered losses, please refer to the Policy Provisions.

- Double Benefit

The Benefit payable under Accidental Death and Dismemberment Benefit shall be doubled if the concerned Accidental Death or Bodily Injury of the Life Insured is caused by one of the following circumstances:

- while the Life Insured is riding as a fare-paying passenger on any public conveyance licensed to carry passengers over an established land, sea or air route;

- while the Life Insured is in an elevator (excluding elevators in mines and on construction sites);

- in consequence of the burning of any theatre, hotel, stadium, shopping mall or Hospital in which the Life Insured is present before the commencement of the fire;

- while the Life Insured is a pedestrian injured in traffic Accident and/or struck by any motor driven or powered vehicle;

- in consequence of Flooding and/or Landslide caused by natural disaster in Hong Kong; or

- while the Life Insured is under Age 19 (age next birthday) and is participating in the School activity(ies) at the time of Accident.

For the avoidance of doubt, the Accidental Death and Dismemberment Benefit will only be doubled once even if 2 or more of the above conditions are met in the same Accident.

- Accidental Medical Expenses Reimbursement Benefit

Medical expenses of treatments and services must be rendered and confirmed as for Medically Necessary by a Registered Medical Practitioner, Chinese Bone-setter, Acupuncturist, Chiropractor and/or Physiotherapist.

Bone-setting, acupuncture, chiropractic treatment and physiotherapy are excluded from A - Medical Expenses Reimbursement.

For the avoidance of doubt, the total claim amount per Accident for (A) Medical Expenses Reimbursement, (B) Bone-Setting and Acupuncture and (C) Chiropractic Treatment and Physiotherapy shall not exceed the maximum amount per Accident for the Accidental Medical Expenses Reimbursement Benefit.

- Accidental Hospital Income Benefit

The Confinement must be confirmed as Medically Necessary and is evidenced by a daily room or room and board charge by the Hospital.

If the Life Insured is hospitalized in Mainland China (other than GBA), the Accidental Hospital Income Benefit will be subject to a maximum of 7 days per Accident. GBA means Macau, Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing (excluding Hong Kong).

Multiple periods of hospitalization will be regarded as part of the same Accident if they arose from the same cause including any and all complications therefrom within 180 days following the latest date of Discharge from a Hospital.

- Non-Accidental Death Benefit

Any outstanding premium will be deducted from Non-Accidental Death Benefit (only applicable if HKD 5,000 is higher than 100% of Total Premiums Paid) when it becomes payable under the Policy.

Benefit limitations and restrictions

Accidental Death and Dismemberment Benefit shall only be paid once under the Policy throughout the Policy Term. The payment made under Accidental Death and Dismemberment Benefit (excluding any additional Benefit payable and/or paid under Double Benefit) throughout the Policy Term shall not exceed 100% of the Sum Insured. When Accidental Death and Dismemberment Benefit is paid or become payable, the Policy shall terminate.

For Accidental Medical Expenses Reimbursement Benefit, the Company will only reimburse the actual expenses incurred, provided that these expenses are not paid or payable under any government, company or insurer under any law, medical programs, or other insurance policies (including any reimbursement from other policies issued by the Company).

If the Life Insured is engaged in an occupation or changed the employment status which is different from the occupation or employment status declared at the application of the Policy and is classified by us as uninsurable as of the date of the Accident, Benefits will not be payable for any Bodily Injury or death directly or indirectly related to the occupation or employment status of the Life Insured.

Change of Occupation

While the Policy is in force, if the Life Insured changes his/her occupation or job duties or employment status or engaged in an additional occupation, the Policyholder must inform us in writing immediately for us to re-evaluate whether the Company can continue to provide the Benefit or the extent of Benefit to be provided; otherwise, the Company will adjust the Benefit payable, or will not pay if a claim arise.

If the Life Insured changes his/her occupation or job duties or employment status or engaged in an additional occupation which is/are classified by us as:

- insurable, we reserve the right revise the Benefit Provisions of the Policy at our sole discretion; or

- uninsurable, we reserve the right to terminate the Policy and refund the premiums paid without interest and less where applicable any amount paid by us for indemnifying the claim previously at our sole discretion.

Exclusions

No Benefits (except for Non-Accidental Death Benefit) shall be payable for any claims, directly or indirectly, caused by or arising from any of the following occurrences:

- on war (declared or undeclared), invasion, insurrection, revolution, use of military power or usurpation of government or military power;

- riot and civil commotion, assault, murder, industrial action or terrorist activity;

- violation or attempted violation of the law or resistance to arrest or participation in any fight or affray;

- the Life Insured engaging in or taking part in naval, military or air force service or operations, or handling of explosives and demolition materials and while under orders for restoration of public order, whether in time of peace or war;

- the Life Insured engaging in air travel, except as a fare paying passenger in any properly licensed private and/or Commercial Aircraft, or as a crew member in a properly licensed Commercial Aircraft operated by a commercial passenger airline on a regular scheduled passenger trip over its established passenger route;

- suicide or attempted suicide or self-inflicted Bodily Injury, or from deliberate exposure to exceptional danger (except in an attempt to save human life), or is sustained whilst the Life Insured is in a state of insanity;

- in the case of a woman, any event attributable wholly or in part to childbirth, miscarriage, pregnancy or any complications concerning therewith notwithstanding that such event may have been accelerated or induced by Bodily Injury;

- any kind of disease or illness (including food poisoning);

- ptomaines or bacterial infection (except pyogenic infection which shall occur with and through an Accidental cut or wound);

- any kind of mental or psychiatric disorder;

- any Pre-existing Condition;

- treatment for dental care or surgery, unless necessitated by Bodily Injury caused by an Accident to sound natural teeth (excluding denture and related expenses);

- cosmetic or plastic surgery, or any elective surgery or congenital anomalies, apart from reconstructive surgery required by Bodily Injury caused by an Accident;

- routine health checks, screening and preventive care/checking, or investigations not directly related to the Bodily Injury for which the Life Insured is admitted or convalescence, custodial or rest care, or any admission that is not Medically Necessary;

- the Life Insured engaging in a sport in a professional capacity or where the Insured would or could earn income or remuneration from engaging in such sport;

- treatment of alcoholism, drug abuse or any other complications arising therefrom, or Accidents caused by and whilst under the influence of drugs or alcohol;

- the Life Insured engaging in any hazardous sports (including but not limited to hang-gliding, parasailing, rock climbing or mountaineering normally involving the use of ropes or guide, parachuting, bungee jumping, racing on wheels or on horse or scuba diving); or

- Acquired Immune Deficiency Syndrome (AIDS) or any complications associated with infection by any Human Immunodeficiency Virus (HIV).

Termination

The Policy shall be terminated on the earliest of the following:

- the death of the Life Insured (whether due to Accidental Death or otherwise);

- the surrender of the Policy;

- failure of submission of the requirement documents for his/her identity verification of the Policyholder within the specified time;

- the lapse of the Policy due to the end of the grace period;

- the Policy Maturity Date;

- Accidental Death and Dismemberment Benefit is paid or become payable;

- the Life Insured’s occupation become uninsurable;

- in our reasonable opinion the Policy has to be terminated to comply with relevant legal and regulatory requirements applicable to us; or

- we first become aware that the Policyholder becomes a sanctioned person under applicable trade and economic laws.

Upon termination as a result of (i) above, the Accidental Death and Dismemberment Benefit or Non-Accidental Death Benefit will be paid by us to the Beneficiary(ies).

Upon termination as a result of (i) (applicable to Accidental Death), (ii), (iv), (v) and (vi) above, the Premium Refund Benefit will be paid by us to the Policyholder.

Upon termination as a result of (iii), (vii) and (ix) above, the Policy will be void and the premium shall be refunded without interest and less where applicable any amount paid by us for indemnifying the claim previously.

Upon termination as a result of (viii) above, no Benefits shall be paid and no premium shall be refunded.

If a Policy is terminated upon on the Policy Maturity Date, coverage under the Policy will be provided up to the Policy Maturity Date.

Once the Policy is terminated, all of our obligations under the Policy is discharged and the Company will no longer be liable to pay any Benefit under the Policy.

Premium payment

You may choose to pay your regular premium monthly or annually (if applicable) throughout the whole Premium Payment Term. You may request to change your regular premium payment frequency by fulfilling the administrative requirement. If the premium(s) is/are due but remain unpaid for 30 days since premium due date, the Policy will be lapsed and you will lose your valuable coverage under the Policy. Premium Refund Benefit shall be paid upon the lapse of the Policy. You may apply for reinstatement after the Policy is lapsed, subject to the terms set out by us and subject to our approval.

Suicide clause

If the Life Insured, whether sane or insane, commits suicide within one year from the Policy Issue Date or the Policy Reinstatement Date, whichever is later, our liability under the Policy will be limited to all premiums paid without interest and less where applicable any amount paid by us for indemnifying the claim previously.

Medically Necessary

It means in respect of medical treatment and/or service, they are:

- consistent with the Diagnosis and customary medical treatment for the condition; and

- in accordance with standards of generally accepted medical practice; and

- not just for the convenience of the Life Insured and his or her relative, or the Registered Medical Practitioner(s).

Experimental and/or unconventional medical technology/procedure performed on the Life Insured are not considered to be Medically Necessary.

Borrowing power

The Policy does not provide Policy loans and has no borrowing power.

Cooling-off period

Provided that no claim has been made under the Policy, the Policyholder has the right to cancel the Policy and obtain a refund of any premium(s) and levy (if any) paid by you, by sending us a written notice to customer@hk.zurich.com through the email address you registered at the time of online application, within 21 calendar days immediately following the day of delivery of the cooling-off notice to you.

Taxation

The levels and bases of taxation that apply to any benefits payable from Zurich Guard will depend on the status of the individual receiving the benefits and will be subject to any changes in relevant tax legislations. You are advised to seek professional advice regarding your own tax circumstances and liability before purchasing a Zurich Guard.

U.S. Foreign Account Tax Compliance Act

Under the U.S. Foreign Account Tax Compliance Act (“FATCA”), a foreign financial institution (“FFI”) is required to report to the U.S. Internal Revenue Service (“IRS”) certain information on U.S. persons that hold accounts with that FFI outside the U.S. and to obtain their consent to the FFI passing that information to the IRS. An FFI which does not sign or agree to comply with the requirements of an agreement with the IRS (“FFI Agreement”) in respect of FATCA and/or who is not otherwise exempt from doing so (referred to as a “nonparticipating FFI”) will face a 30% withholding tax (“FATCA Withholding Tax”) on all “withholdable payments” (as defined under FATCA) derived from U.S. sources (initially including dividends, interest and certain derivative payments).

The U.S. and Hong Kong have agreed an inter-governmental agreement (“IGA”) to facilitate compliance by FFIs in Hong Kong with FATCA and which creates a framework for Hong Kong FFIs to rely on streamlined due diligence procedures to (i) identify U.S. indicia, (ii) seek consent for disclosure from its U.S. Policyholders and (iii) report relevant tax information of those Policyholders to the IRS.

FATCA applies to us and the Policy. We are a participating FFI and are committed to complying with FATCA. To do so, we require you to:

- provide us with certain information including, as applicable, your U.S. identification details (e.g. name, address, the U.S. federal taxpayer identifying numbers, etc.); and

- consent to us reporting this information and your account information (such as account balances, interest and dividend income and withdrawals) to the IRS.

We could, in certain circumstances, be required to impose FATCA Withholding Tax on payments made to, or which it makes from, your Policy. Currently the only circumstances in which we may be required to do so are:

i. if the Inland Revenue Department of Hong Kong (the “IRD”) fails to exchange information with the IRS under IGA (and the relevant tax information exchange agreement between Hong Kong and the U.S.), in which case we may be required to deduct and withhold FATCA Withholding Tax on withholdable payments made to your Policy and remit this to the IRS; and

ii. if you are (or any other account holder is) a nonparticipating FFI, in which case we may be required to deduct and withhold FATCA Withholding Tax on withholdable payments made to your Policy and remit this to the IRS.

You should seek independent professional advice on the impact FATCA may have on you or your Policy.

The Automatic Exchange of Information (“AEOI”)

As a result of G20-led initiative carried out by the Organisation for Economic Cooperation and Development, Hong Kong will exchange financial account information with other jurisdictions, thereby enabling them to know taxpayers who place their assets abroad.

Under AEOI, banks and other financial institutions collect and report to the tax authority information in relation to financial accounts held by residents of reportable jurisdictions. The IRD exchanges this information with the foreign tax authorities of those residents of reportable jurisdictions (i.e. jurisdictions with which Hong Kong has signed the competent authority agreement). In parallel, the IRD receives financial account information on Hong Kong residents from foreign tax authorities.

We must comply with the following requirements of the Inland Revenue Ordinance to facilitate the IRD automatically exchanging certain financial account information as provided for thereunder:

- to identify certain accounts as reportable accounts*;

- to identify the jurisdiction(s) in which reportable account* holding individuals and entities reside for tax purposes;

- to determine the status of certain reportable account* holding entities as “passive nonfinancial entities” and identify the jurisdiction(s) in which their “controlling persons” reside for tax purposes;

- to collect certain information on reportable accounts* (“Required Information”); and

- to furnish certain Required Information to the IRD (collectively, the “AEOI requirements”).

Please contact your licensed insurance intermediary for more details and professional advice if you are in doubt with the AEOI.

* “Reportable Account” has the meaning ascribed to it under the Inland Revenue Ordinance (Cap.112).

Termination right due to regulatory exposure

If you move to another country during the lifecycle of your Policy, you must notify us of such planned change prior to such change but no later than within 30 days of such change. Please note that you may no longer be eligible to make payments into your Policy. The local laws and regulations of the jurisdiction to which you move may affect our ability to continue to service your Policy in accordance with the Policy Provisions. Therefore, we reserve all rights to take any steps that we deem appropriate, including the right to cancel the Policy.

Surrender

You may surrender the Policy at any time by giving us written notice. Premium Refund Benefit shall be paid upon the surrender of the Policy. Upon surrender, the Policy shall be terminated.

Authorization

Zurich Guard is issued by Zurich, which is subject to the prudential regulation of the Insurance Authority of Hong Kong (“IA”).

Insurance Authority levy

From January 2018, the Insurance Authority requires all Hong Kong policyholders to pay a levy on their insurance premiums. The purpose of the levy is to finance the IA, and it is calculated as a percentage of the premium paid. The levy collected by the IA will be imposed on the Policy at the applicable rate.

For more information on levy, please visit our website at http://www.zurich.com.hk/ia-levy or webpage of the Insurance Authority at www.ia.org.hk/en.

Governing law

The Policy shall be governed by and construed in accordance with the laws of the Hong Kong Special Administrative Region.

In the event of dispute, it will be resolved by the courts of Hong Kong.

Complaints and enquiries

If you are dissatisfied with our service, you have the right to complain by contacting us. If you have any enquiries, you can also contact us.

Key risks

- Inflation risk

Please note that the cost of living in the future is likely to be higher than it is today due to inflation. In that case you will receive less in real terms even if we meet all of our contractual obligations under the Policy.

- Credit risk

Zurich Guard is an insurance Policy issued by us. Therefore, the benefits payable under the Policy are subject to our credit risks. If we are unable to satisfy the financial obligation of the Policy, you may lose your premiums paid and benefits.

- Currency conversion and exchange rate risk

We may at our discretion accept any premium payment in currencies other than the Policy Currency. If it is the case, we will convert the premium paid by you into the Policy Currency. The currency conversion will be conducted at a prevailing exchange rate reasonably determined by us in good faith and a commercially reasonable manner with reference to the market rates on the transaction date and is therefore subject to foreign exchange risks. Please refer to www.zurich.com.hk for the prevailing exchange rates.

- Changes of Benefits and/or regular premiums

The Company reserves the right to amend and/or revise the Benefits, relevant limitations and restrictions and/or the regular premiums of the Policy upon each Policy Anniversary by providing a written notice to you at least 3 months prior to such change(s) taking effect, to the extent reasonably required to cover: i) increase in administration and other costs reasonably incurred by the Company; and/or ii) the cost of additional charges, levies or taxes which apply to the Policy or to us as a whole; and/or iii) any additional costs associated with changes to legislative or regulatory requirements; and/or iv) expectations regarding long term accidental claims; and/or v) increases in any underlying expenses, including reinsurance charges; and/or vi) the impact of medical advance in the treatment and/or cure of applicable mortality and morbidity risks. The revised Benefits, relevant limitations and restrictions and/or regular premiums will automatically take effect for the Policy unless you decline them by giving us a written request to surrender the Policy at least 30 calendar days before such revision takes effect.

This product factsheet does not contain the full terms of the Policy and the full terms can be found in the Policy documents and provisions. Please make sure you consider your liquidity needs when considering the premium affordability of the Policy.

You should carefully read this product factsheet, benefit illustration document and the Policy Provisions before you make your decision on your purchase of this plan.

The information in this document is intended as a general summary for your reference only and does not constitute financial, investment or taxation advice or advice of whatsoever kind. You are recommended to seek professional advice if you find it necessary. For full terms and conditions, please refer to the Policy Provisions which shall prevail in case of inconsistency. In the event of any discrepancy between the English and Chinese versions, the English version shall prevail. Zurich Life Insurance (Hong Kong) Limited reserves the right of final approval and decision on all matters.

This document is intended to be distributed in Hong Kong only and shall not be construed as an offer to sell or a solicitation to buy or provision of any of our products outside Hong Kong. We hereby declare that we have no intention to offer to sell, to solicit to buy or to provide any of our products in any jurisdiction other than Hong Kong in which such offer to sell or solicitation to buy or provision of any of our products is illegal under the laws of that jurisdiction.

Resources that may help

*Only available in Traditional Chinese

In the event of any discrepancy or inconsistencies between the English and Chinese versions, the English version shall prevail.