Investment Tips and Return Concepts

Savings and InvestmentsArticleDecember 21, 2022

Investment plays an important role in financial planning. However, while making profits through investments, investors may also face the risks of loss. As investors, it is necessary to understand the relationship between risk and return, then select the most suitable investments according to different risk profile levels.

For now, let’s begin with the simple concept of risk and return, then understand common asset classes in the market. This helps you achieve your financial goals step by step!

What is risk?

In short, risk is the uncertainty in certain situations. For investment, risk generally refers to the changes in the rate of return on an investment. This movement can be calculated in different ways, including volatility, which represents how rapid and how much an investment's price rises or falls over a period. When the price rises and falls rapidly in a short period of time, it is a high volatility; and if the price remains unchanged, it is a low volatility.

What is return?

Risk and return are closely related. In general, the higher the risk, the greater the potential return (or the loss). Since different asset classes have different risk and return ratios, investors should carefully choose the most suitable investment for themselves according to their financial goals and risk profile.

Common asset classes

- Derivatives: The riskiest category which is highly-leveraged and with relatively higher returns.

- Equities: Traditionally riskier asset class, which can offer relatively high returns if investors can withstand short-term price fluctuations in stocks.

- Cash: Low risk and stable, but the return potential is relatively low.

To learn more, please refer to the table below for the asset classes’ risk and return profiles in general.

|

Cash

|

Relatively low risk*, guaranteed to get back the principal |

|

Bond

|

Relatively low risk* with fixed interest |

|

Fund

|

Risk and return depend on the investment objective and investment strategy of the fund which may be higher or lower |

|

Equities

|

Relatively high risk*, return is uncertain |

|

Derivatives

|

Relatively high risk* |

* The returns of each investment class vary according to the investment risk.

In general, the higher the risk, the greater the potential return (or loss).

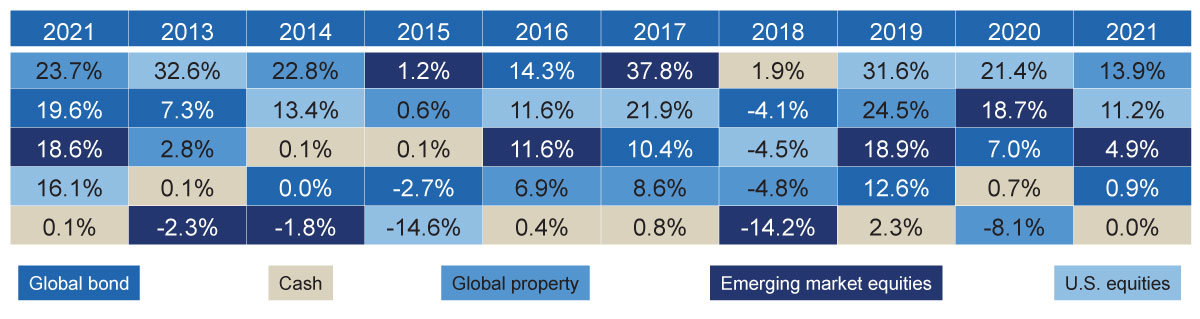

Calendar year returns by asset class (% per year)

Source: BlackRock Think Tank, MSCI U.S. Indices, MSCI Emerging Markets Indices, Bloomberg Barclays U.S. Treasuries Data, S&P Global Property Investment Trust Index, data as of May 3, 2021. 2021 return performance as of April 30, 2021

Diversified investment

Diversified investment strategy is to form a portfolio of different asset classes to reduce investment risk. While the value of individual assets may fall, the chance of a simultaneous decline in all asset classes is low. Diversification allows investors to seek more opportunities for investment growth. Basically, multi-asset allocation means "Don't put all your eggs in one basket".

While every investor's investment portfolio is different, it is important to maintain diversification regardless of your financial goals, age or risk profile. The goal of diversification of assets can be achieved by investing in different asset classes. Key asset classes including:

- Cash or money market;

- Bond or fixed income investments;

- Marketable securities, i.e. company shares or shares;

- Alternative funds, e.g. real estate, commodities, hedge funds or private equity. These asset classes can be distinguished by geographic location, industry, investment style and size of the company invested.

Different asset classes have different long-term performance, so risk and return are also different. The most important thing in diversification is to know how to invest in different classes of asset. Since the market conditions of one asset type have a lower chance to affect another type of assets, it helps to reduce investment risks.

Prepare for the future with our life insurance options

Whether you’re saving to protect your family’s financial future, leaving a legacy for your children, or simply preparing for a rainy day, our extensive line of life insurance plans is here to take care of you and your loved ones, no matter what life brings.

Disclaimer

The information contained in this material is for informational purposes only and is not intended to constitute any recommendation or advice to any person. Readers should not make any decision based solely on the information contained herein. Before acting on any information in this material, readers should consider their personal situation and seek independent advice.

The information contained in this material does not constitute an offer for the purchase or sale of any insurance products or services. No insurance product or service is deemed to be offered, marketed or solicited for sale in any jurisdiction in which such offer, marketing or solicitation would be unlawful under the laws of such jurisdiction.

Zurich Insurance (Hong Kong) has based this material on information obtained from sources it believes to be reliable, but it does not warrant the correctness, adequacy and completeness of the information contained herein.

The information contained in this material may not be reproduced either in whole, or in part, without prior written permission of Zurich Insurance (Hong Kong). In no event shall Zurich Insurance (Hong Kong) be liable for any damages or losses arising out of or in connection with the use, reliance on or distribution of the information contained in this material by any person.