Zurich Care Critical Illness Insurance Plan

Limited time offers 💰

Main Features

| No Claim Refundable Premium Option | Non-Refundable Premium Option | |

|---|---|---|

| Limited time offer 💰 |

For policies with 10-year premium payment term, enjoy total premium of HKD 10 for the first 3 months + Free first-year "SoCare Health Pass" (worth HKD 390)

Terms & Conditions apply

Enjoy a 1% premium discount on single premium policy + Free first-year "SoCare Health Pass" (worth HKD 390)

Terms & Conditions apply

|

Total premium of HKD 10 for the first 3 months + Free first-year "SoCare Health Pass" (worth HKD 390)

Terms & Conditions apply

|

| Covered 81 critical illnesses and cancer drug benefit | ✓ | ✓ |

| Premium refund benefit | ✓ | X |

| Renewal | X | ✓ |

| Policy term | 10 years | To age 86 (age next birthday) |

| Premium payment term | Single premium /10 years |

To age 86 (age next birthday) |

| Premium | Higher | Lower |

|

Monthly premium^

Sum insured: HKD 100,000/Male/Non-smoker

|

Age of 25: HKD 253 |

Age of 25: HKD 6 |

^For the No Claim Refundable Premium Option, it assumes the premium payment term is 10 years, while the Non-Refundable Premium Option assumes a yearly premium renewable term. All premiums are excluded levy and are rounded to the nearest whole number.

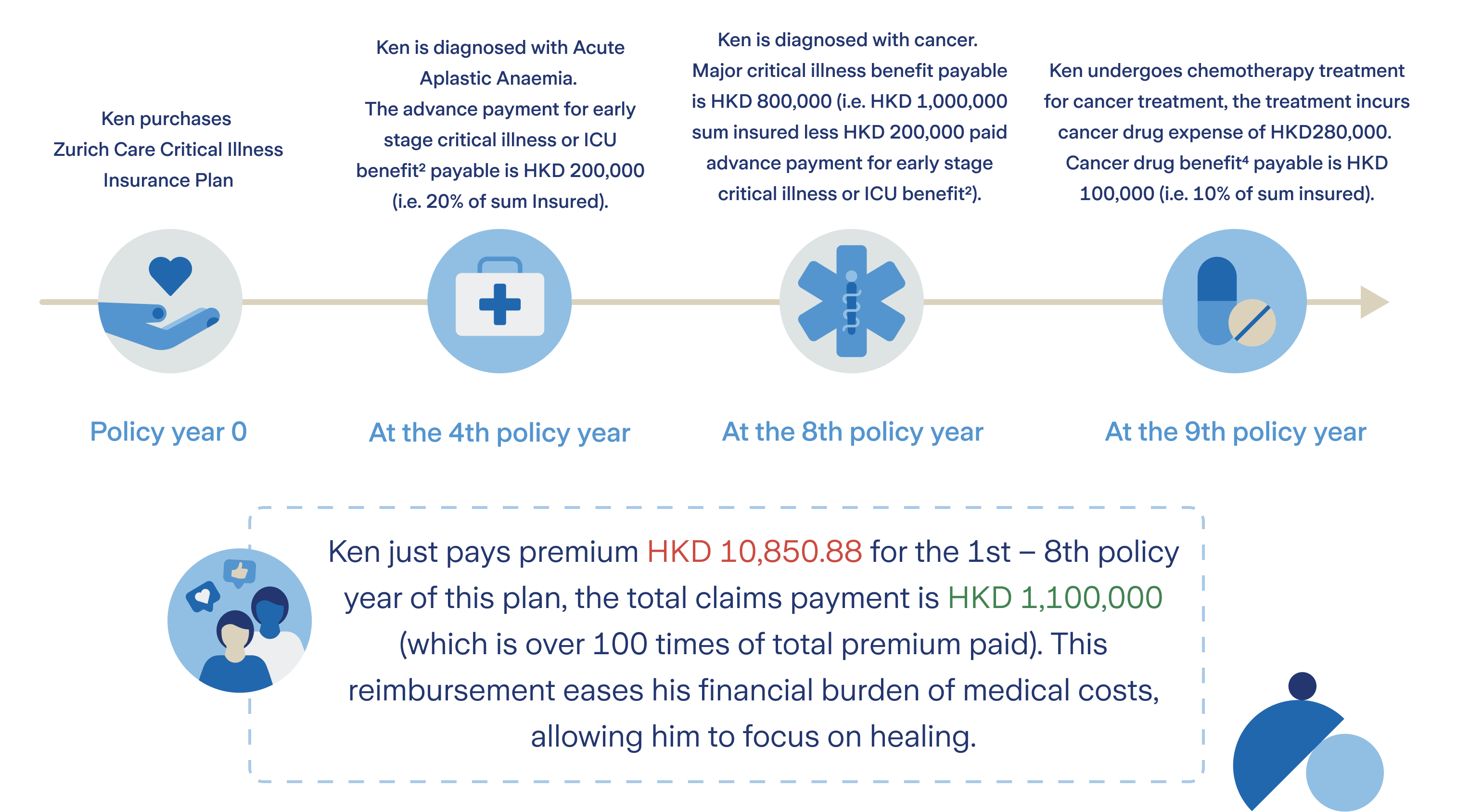

Case Studies

Product Information

| No Claim Refundable Premium Option | Non-Refundable Premium Option | |

|---|---|---|

| Premium payment term | Single premium/10 years | To age 86 (age next birthday) |

| Policy term | 10 years | To age 86 (age next birthday) |

| Premium renewable term | N/A | Yearly/5 years/10 years |

| Premium payment frequency | Monthly/annually (not applicable to single premium) |

Monthly/annually |

| Minimum sum insured (per policy) | HKD 30,000 | HKD 100,000 |

| Maximum sum insured (per product) | 1-18 (age next birthday): HKD 800,000 19-55 (age next birthday): HKD 1,500,000 56-60 (age next birthday): HKD 1,000,000 61-66 (age next birthday): HKD 500,000 |

|

| Issue age | 1-66 (age next birthday) |

|

| Policy currency | HKD | |

| Waiting period | 90 days | |

| Residency | The policyholder and the life insured must be Hong Kong residents | |

Frequently Asked Questions (FAQ)

Know more

Benefit limitations and restrictions

The aggregate of benefit made hereunder throughout the policy term shall not exceed:

i. one hundred and ten percent (110%) of the total premiums paid payable to death benefit (applicable to No Claim Refundable Premium Option)/ five percent (5%) of the sum insured payable to death benefit (applicable to Non-Refundable Premium Option); or

ii. one hundred and ten percent (110%) of the sum insured payable to major critical illness benefit, advance payment for early stage critical illness benefit or ICU benefit2 and cancer drug benefit4.

If the life insured dies before the cancer drug benefit4 reaches the limit, a compassionate death remuneration of HKD 5,000 will be paid to the beneficiary(ies).

Death benefit, major critical illness benefit, premium refund benefit (only applicable to No Claim Refundable Premium Option) and advance payment for early stage critical illness benefit or ICU benefit2 shall not be paid more than once under the policy throughout the policy term. Once the death benefit becomes payable or all other benefits become payable to the policyholder, all of our obligations under the policy is discharged and we will no longer be liable to pay any benefit to the policyholder under the policy.

Exclusions

No major critical illness benefit or advance payment for early stage critical illness benefit or ICU benefit2 or cancer drug benefit4 shall be payable for any claims, directly or indirectly, caused by or arising from any of the following occurrences:

i. The critical illness existed before the policy issue date, or the policy reinstatement date, whichever is the latest;

ii. Any pre-existing conditions from which the life insured has been suffering from;

iii. The life insured is diagnosed with a critical illness by a registered medical practitioner, or has shown any signs or symptoms of any critical illness disease or physical condition which may be the cause or triggering condition of a critical illness within the waiting period5 of 90 days from the policy issue date or the policy reinstatement date, whichever is the latest (except when a critical illness is caused by an accident);

iv. Suicide or attempted suicide or self-inflicted injuries, whether sane or insane;

v. Any Acquired Immune Deficiency Syndrome (AIDS), AIDS-related complex or infection by Human Immunodeficiency Virus (HIV), except for AIDS due to blood transfusion or HIV Acquired due to Assault or Occupationally Acquired HIV;

vi. Any congenital or inherited disorder or developmental condition (only applicable if the disorder gives rise to signs or symptoms or was diagnosed before the life insured reaches age nine (age next birthday) of the life insured;

vii. Narcotics used by the life insured unless it is taken as prescribed by a registered medical practitioner, or the life insured’s abusive use of drugs and/or alcohol;

viii. Violation or attempted violation of the law or participation in fight or affray or resistance to arrest;

ix. War, whether declared or undeclared, revolution or any warlike operations;

x. Entering, exiting, operation, being transported, or in any way engaging in air travel except as a fare paying passenger in any aircraft operated by a commercial passenger airline on a regular scheduled passenger trip over its established passenger route.

Termination

The policy shall be terminated on the earliest of the following:

i. the death of the life insured;

ii. the surrender of the policy;

iii. failure of submission of the requirement documents for his/her identity verification of the policyholder within the specified time;

iv. the lapse of the policy due to the end of the grace period;

v. the policy maturity date (for No Claim Refundable Premium Option) /policy expiry date (for Non-Refundable Premium Option);

vi. the major critical illness benefit is paid or payable (except the life insured confirmed diagnosis of cancer);

vii. upon reaching the maximum payable limit for the cancer drug benefit4;

viii. in our reasonable opinion the policy has to be terminated to comply with relevant legal and regulatory requirements applicable to us;

ix. 24 months after the first confirmed diagnosis of cancer; or

x. we first become aware that the policyholder becomes a sanctioned person under applicable trade and economic laws.

In respect of termination as a result of (i) above, the 110% of total premiums paid (applicable to No Claim Refundable Premium Option) / 5% of sum insured (applicable to Non-Refundable Premium Option) for death benefit minus any outstanding premium (applicable to regular premium payment term), will be paid by us to the beneficiary.

Policy will be void and the premium shall be refunded without interest if the policy is terminated upon (iii) above.

The policy has no cash value. For the avoidance of doubt, no benefits and no surrender value shall be paid and no premium shall be refunded if the policy is terminated upon (ii), (iv), (v) (applicable to Non-Refundable Premium Option), (vii), (viii) and (ix) above. The premium will be refunded without interest if the policy is terminated upon (x).

If a policy is terminated upon the policy maturity date/policy expiry date, coverage under the policy will be provided up to the policy maturity date/policy expiry date.

Premium payment

You may choose to pay your regular premium monthly or annually (if applicable) throughout the whole premium payment term. Premium is fixed within the first premium renewal term unless you request to reduce the sum insured subsequently (only applicable to Non-Refundable Premium Option). You may request to change your regular premium payment frequency by fulfilling the administrative requirement. If the premium(s) is/are due but remain unpaid for 30 days since premium due date, the policy will be lapsed and you will lose your valuable coverage under this policy. You may apply for reinstatement after the policy is lapsed, subject to the terms set out by us and subject to our approval. Please note that the premiums will not be reduced as a result of any advance payment for early stage critical illness benefit or ICU benefit2 being paid and/or payable.

Suicide clause

If the life insured, whether sane or insane, commits suicide within one year from the policy issue date or the policy reinstatement date, whichever is later, our liability under the policy will be limited to the refund of total premiums paid (without interest) and less any advance payment for early stage critical illness benefit or ICU benefit2 paid and/or payable and any outstanding premium of the policy.

Medically necessary

It means in respect of medical treatment and/or service, they are:

i. consistent with the diagnosis and customary medical treatment for the condition; and

ii. in accordance with standards of generally accepted medical practice; and

iii. not just for the convenience of the life insured and his or her relative, or the registered medical practitioner(s).

Experimental and/or unconventional medical technology/procedure performed on the life insured are not considered to be medically necessary.

Borrowing power

This policy does not provide any cash value for policy loans and has no borrowing power.

Cooling-off period

Provided that no claim has been made under the policy, the policyholder has the right to cancel the policy and obtain a refund of any premium(s) and levy (if any) paid by you, by sending us a written notice to customer@hk.zurich.com through the email address you registered at the time of online application, within 21 calendar days immediately following the day of delivery of the cooling-off notice to you.

Termination right due to regulatory exposure

If you move to another country during the lifecycle of your policy, you must notify us of such planned change prior to such change but no later than within 30 days of such change. Please note that you may no longer be eligible to make payments into your policy. The local laws and regulations of the jurisdiction to which you move may affect our ability to continue to service your policy in accordance with the policy provisions. Therefore, we reserve all rights to take any steps that we deem appropriate, including the right to cancel the policy.

Surrender

You may surrender the policy at any time by giving us written notice. No surrender value shall be paid upon the surrender of the policy. The policy has no cash value and no benefits are payable on surrender. Upon surrender, the policy shall be terminated.

Authorization

Zurich Care is issued by Zurich, which is subject to the prudential regulation of the Insurance Authority of Hong Kong (“IA”).

Insurance Authority levy

From January 2018, the Insurance Authority requires all Hong Kong policyholders to pay a levy on their insurance premiums. The purpose of the levy is to finance the IA, and it is calculated as a percentage of the premium paid. The levy collected by the IA will be imposed on this policy at the applicable rate.

For more information on levy, please visit our website at http://www.zurich.com.hk/ia-levy or webpage of the Insurance Authority at www.ia.org.hk/en.

Governing law

The policy shall be governed by and construed in accordance with the laws of the Hong Kong Special Administrative Region.

Dispute resolution

In the event of dispute, it will be resolved by the courts of Hong Kong.

Complaints and enquiries

If you are dissatisfied with our service, you have the right to complain by contacting us. If you have any enquiries, you can also contact us.

1. Angioplasty and Other Invasive Treatments for Coronary Artery Disease

2. Carcinoma-in-situ

3. Cerebral Aneurysm Requiring Surgery

4. Biliary Tract Reconstruction Surgery

5. Chronic Kidney Disease and Surgical Removal of One Kidney

6. Liver Surgery (partial hepatectomy)

7. Major Organ Transplantation (on Waiting List)

8. Surgical Removal of either Left or Right Lung

9. Cardiac Pacemaker/Defibrillator Insertion

10. Acute Aplastic Anaemia

^For details of the definitions of the covered major critical illnesses and early stage critical illness, please refer to the policy documents and provisions.

1. Cancer*

2. Cerebral Metastasis

3. Acute Necrohemorrhagic Pancreatitis

4. Aplastic Anaemia

5. Chronic Relapsing Pancreatitis

6. End Stage Liver Failure

7. End Stage Lung Disease

8. Fulminant Hepatitis

9. Kidney Failure

10. Major Organ Transplant

11. Medullary Cystic Disease

12. Crohn's Disease

13. Systemic Lupus Erythematosus (SLE)

14. Systemic Scleroderma

15. Ulcerative Colitis

16. Cardiomyopathy

17. Dissecting Aortic Aneurysm

18. Eisenmenger’s Syndrome

19. Heart Attack

20. Infective Endocarditis

21. Primary Pulmonary Arterial Hypertension

22. Heart Valve Replacement/Repair

23. Surgery for Disease of the Aorta

24. Surgery to Coronary Arteries with By-Pass Grafts

25. Alzheimer's Disease/Irreversible Organic Degenerative Brain Disorder

26. Amyotrophic Lateral Sclerosis (ALS)

27. Apallic Syndrome

28. Bacterial Meningitis

29. Benign Brain Tumor

30. Coma

31. Creutzfeldt-Jakob Disease

32. Total Deafness

33. Encephalitis

34. Hemiplegia

35. Major Head Trauma

36. Meningeal Tuberculosis

37. Multiple Sclerosis

38. Muscular Dystrophy

39. Paralysis

40. Parkinson’s Disease

41. Poliomyelitis

42. Primary Lateral Sclerosis

43. Progressive Bulbar Palsy (PBP)

44. Progressive Muscular Atrophy

45. Progressive Supranuclear Palsy

46. Spinal Muscular Atrophy

47. Stroke

48. Total Blindness

49. AIDS due to Blood Transfusion

50. Chronic Adrenal Insufficiency (Addison's Disease)

51. Diabetic Complications

52. Ebola

53. Elephantiasis

54. Haemolytic Streptococcal Gangrene

55. HIV Acquired due to Assault

56. Loss of Limbs

57. Loss of One Limb and One Eye

58. Loss of Speech

59. Major Burns

60. Occupationally Acquired HIV

61. Severe Rheumatoid Arthritis

62. Severe Osteoporosis

63. Terminal Illness

64. Necrotising Fasciitis

65. Other Serious Coronary Artery Disease

66. Severe Myasthenia Gravis

67. Systemic Sclerosis

68. Chronic Auto-immune Hepatitis

69. Pheochromocytoma

70. Severe Pulmonary Fibrosis

71. Loss of Independent Existence

^For details of the definitions of the covered major critical illnesses and early stage critical illness, please refer to the policy documents and provisions.

*Cover for Cancer under major critical illnesses do not include Tumor of the Thyroid (at TNM classification T1N0M0 or a lower stage); Tumor of the Prostate (at TNM classification T1a or T1b or T1c or a lower stage); Chronic Lymphocytic Leukaemia classified as less than RAI stage III; Skin Cancer (except Malignant Melanoma); any Cancer where HIV infection is also present; and any pre-malignant or non-invasive Cancer or Carcinoma-in-situ , or as having either borderline malignancy or low malignant potential.

1. This is based on Zurich’s research market conditions as of August 20, 2024 and comparison among other online critical illness products for Composite and Long Term Businesses as defined by the Insurance Authority in the Register of Authorized Insurers.

2. The aggregate limit of advance payment for each of the covered early stage critical illness or ICU benefit shall not exceed HKD 300,000 per life insured under all policies of the Zurich Care issued by Zurich. For the ICU benefit, the life insured must stay in an Intensive Care Unit of a hospital for a consecutive three days or more and be diagnosed with a known/unknown disease or injuries. The ICU stay must be confirmed as medically necessary treatment by a registered medical practitioner.

3. Specified disability means Terminal Illness/Coma/Loss of Independent Existence/Apallic Syndrome/Major Head Trauma or Paralysis. In case the policyholder suffers from a specified disability, the contingent policyholder will become the new policyholder of the policy and he/she can exercise all rights under the policy including making any claim and managing the policy, after he/she submits relevant proof of the specified disability and subject to our approval.

4. Cancer drug benefit must be confirmed as for medically necessary of cancer drug expenses for the purpose of cancer treatment, including Chemo/Immune/Targeted therapy prescribed by the doctor. The cancer drug benefit is payable on a reimbursement basis and subject to a maximum payable limit of (1) 10% of the sum insured or (2) HKD 120,000 per life insured under all policies of Zurich Care issued by Zurich (whichever is lesser). In the unfortunate event that the life insured passes away before reaching the maximum payable limit, a compassionate death remuneration of HKD 5,000 will be paid. The cancer drug benefit shall automatically terminate on the occurrence of the earliest of the following:

- upon the cancer drug benefit reaches the maximum payable limit;

- 24 months after the first confirmed diagnosis of cancer;

- policy expiry date(for Non Refundable Premium Option)/policy maturity date(for No Claim Refundable Premium Option);

- the death of the life insured.

5. A waiting period of 90 days applies and no major critical illness benefit, advance payment for early stage critical illness benefit or ICU benefit2 and cancer drug benefit4 shall be payable within 90 days immediately from the policy issue date, or the policy reinstatement date, whichever is the latest (except when a critical illness is caused by an accident).

This product factsheet does not contain the full terms of the policy and the full terms can be found in the policy documents and provisions. Please make sure you consider your liquidity needs when considering the premium affordability of the policy.

You should carefully read this product factsheet and the policy provisions before you make your decision on your purchase of this plan.

The information in this document is intended as a general summary for your reference only and does not constitute financial, investment or taxation advice or advice of whatsoever kind. You are recommended to seek professional advice if you find it necessary. For full terms and conditions, please refer to the policy provisions which shall prevail in case of inconsistency. In the event of any discrepancy between the English and Chinese versions, the English version shall prevail. Zurich Life Insurance (Hong Kong) Limited reserves the right of final approval and decision on all matters.

This document is intended to be distributed in Hong Kong only and shall not be construed as an offer to sell or a solicitation to buy or provision of any of our products outside Hong Kong. We hereby declare that we have no intention to offer to sell, to solicit to buy or to provide any of our products in any jurisdiction other than Hong Kong in which such offer to sell or solicitation to buy or provision of any of our products is illegal under the laws of that jurisdiction.

Detailed information

*Only available in Traditional Chinese

In the event of any discrepancy or inconsistencies between the English and Chinese versions, the English version shall prevail.